We proudly invite you to join the Kevin McDonald Legacy Society!

The Kevin McDonald Legacy Society is a special group of generous and thoughtful donors who support TROSA’s longevity and the future success of our men and women in recovery by including TROSA in their will or estate planning.

You can learn more about joining the Kevin McDonald Legacy Society by contacting TROSA’s Development Office: 919-419-1059 ext 1600 or development@trosainc.org TROSA’s Tax ID number is 56-1861158.

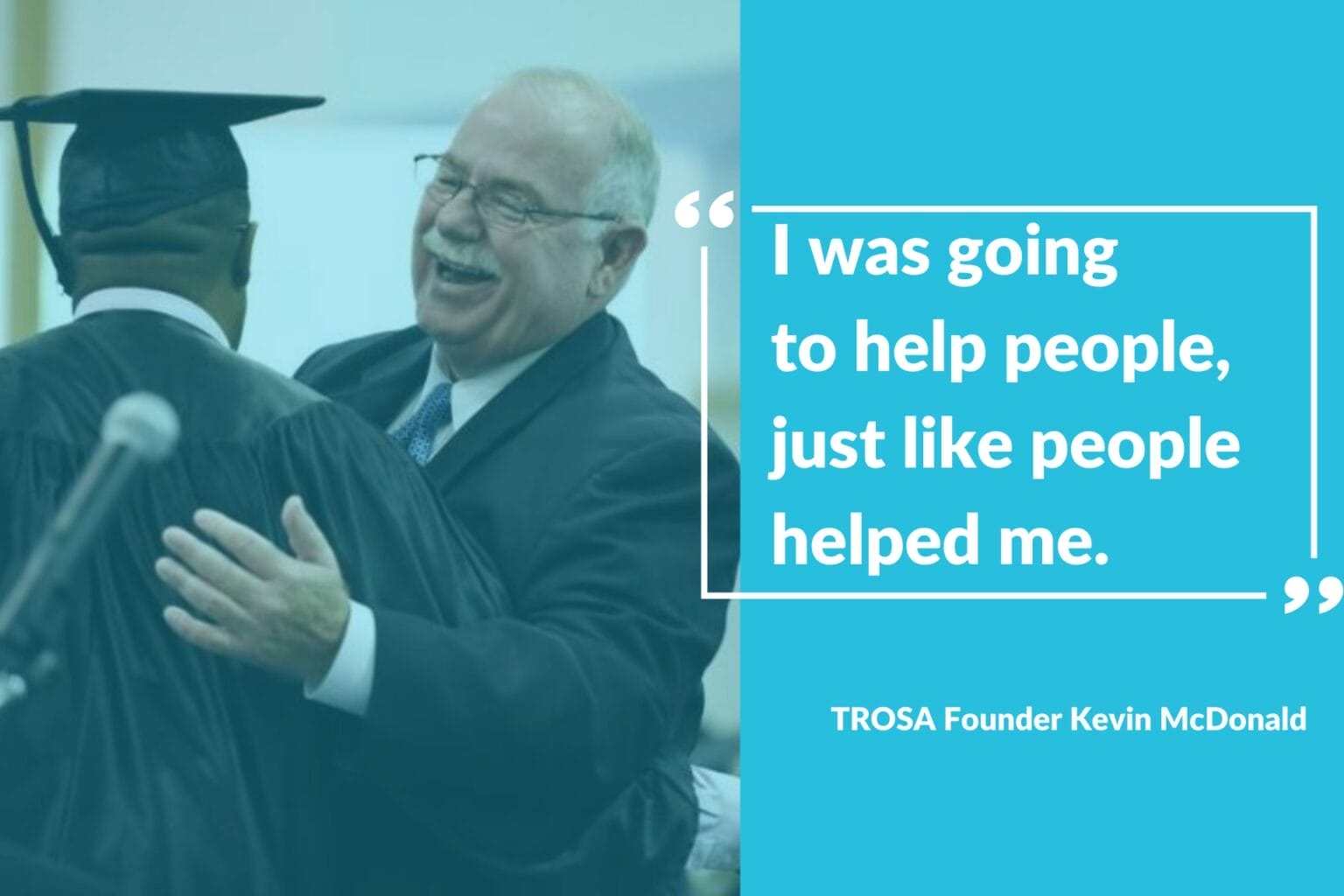

This group is named to honor and thank TROSA’s Founder Kevin McDonald. Kevin founded TROSA in 1994 to help people overcome addiction. His idea, drive, and heart have saved thousands of lives. Now, you can make your own life-changing impact for our residents and their families by joining this special group of supporters.

If you have already included TROSA in your future giving with a planned gift, please let us know so we can thank you and help ensure that your plans are realized.

A bequest is a very meaningful and simple way to leave a legacy of support at TROSA. And if you have already drafted your will, you can easily include TROSA at any time by way of a codicil. A codicil is a document your attorney can prepare to amend your will or trust without rewriting the entire document. The codicil adds a new gift to TROSA while reaffirming the other terms of your will. You can make a bequest to TROSA for a specific dollar amount or a percentage of your estate.

Read below below to see sample language for how to include TROSA in your plans

I hereby give and bequeath $_____ dollars to Triangle Residential Options for Substance Abusers, Inc. (TROSA), a North Carolina charitable entity (whose principal address is 1820 James Street, Durham, North Carolina 27707) to be used at the discretion of TROSA for its general charitable purposes. TROSA’s tax identification number is 56-1861158.

You can also make a residuary bequest to TROSA, which gives all or a portion of the residue of your estate to TROSA after payment of expenses and after specific amounts are allocated to designated beneficiaries. Sample language is below:

I hereby give and bequeath ____ percent (%) of the residue of my estate to Triangle Residential Options for Substance Abusers, Inc. (TROSA), a North Carolina charitable entity (whose principal address is 1820 James Street, Durham, North Carolina 27707) to be used at the discretion of TROSA for its general charitable purposes. TROSA’s tax identification number is 56-1861158.

An individual aged 70 ½ and older can also make charitable gifts of up to $108,000 today through your IRA charitable distributions, which may realize tax benefits to you now while helping to make TROSA residents’ dreams possible.

Click “Expand” in the link below to learn more:

If you are 70 ½ or older, you may transfer up to $108,000 directly from your IRA to charitable organizations each year, without counting the distributions as taxable income. Additionally, if you are 72 or older, your IRA Charitable Rollover gift (also known as a Qualified Charitable Distribution) can count toward satisfying your required minimum distribution each year. TROSA’s tax ID (EIN) number is 56-1861158.

An IRA Charitable Rollover gift is easy to make, and there is no minimum gift amount. Simply contact your IRA administrator to learn how to initiate a direct transfer from your account as a gift to TROSA.

Important Note: As with all charitable giving, we encourage you to talk to an accountant or tax advisor to ensure you are receiving the maximum benefit for yourself as there may be limitations to this type of giving.

Do you have a vehicle, home, or other property of value that you may want to leave to TROSA?

Note: If looking to make a vehicle donation today (thank you!) please fill out our vehicle donation inquiry form by clicking this link.

There are national and local organizations that allow you to create a DAF. DAFs usually require a minimum amount to establish a fund and then those funds are distributed to nonprofits over time. When you establish a DAF, you may receive immediate tax benefits and then can make recommendations on how your assets are distributed to help nonprofits like TROSA.

You can also name TROSA as a beneficiary of your life insurance policy. You can donate ownership and receive a charitable income tax deduction for the market value of the policy or you can retain the policy and name TROSA as a beneficiary and your estate will receive the tax deduction from the charitable gift receipt.

If you have bonds that have stopped earning interest and that you plan to redeem, you will owe income tax on the appreciation. In the end, your heirs could receive only a fraction of the value of the bonds in which you so carefully invested. As TROSA is a tax-exempt organization, naming us as a beneficiary of your savings bonds ensures that your investment will go far with a gift to help men and women change their lives.